Crafting a successful product is no easy feat. Eliminating uncontrollable factors such as timing, and pure luck, an organization must also ensure its product is feasible, viable, and desirable.

This synergistic requirement (feasibility, viability, and desirability) for long-term success cannot be short-changed. A successful product cannot meet only some of these criteria; it must meet all of them.

In the product engineering world we have seen our share of ‘false gods’–products and platforms that met one or two of these principles and appeared to be set for success. For example, Carvana and Peleton drove real disruption for a substantial period of time. Both companies crafted technology solutions which made immediate impact, met a market need, and (for a myriad of reasons) achieved financial viability. Yet, both ultimately fell back to Earth because they were incapable of unlocking their full potential, and adjusting to competitor and financial headwinds.

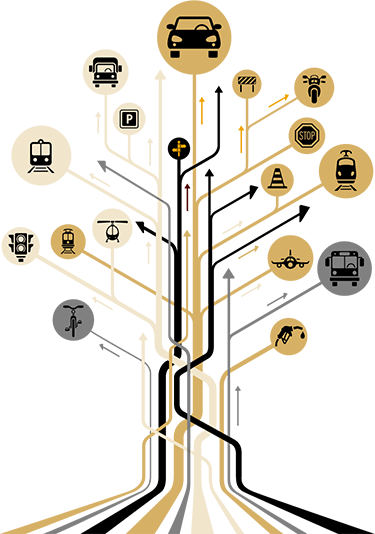

For some time, we have been experiencing a revolution in the monetization of platforms and applications, especially in the automotive industry. And the viability of this marketplace (both in-vehicle and vehicle as a subscription) is in serious question.

A question of viability

Historically, feasibility is the easiest hurdle to clear in product engineering. With enough money and engineering talent, a group of qualified engineers can build almost anything. Desirability can be achieved with a robust research and design approach, and the appropriate level of market research, user testing, strategic roadmapping and data analysis. The barrier is viability.

Viability–for our discussion–refers to the ability of a business to survive, and that survival being directly linked to financial positions and performance. To date, the in-vehicle subscription economy (and to a lesser extent automotive subscriptions) has consistently failed to prove industry-wide viability.

The list of bad bets increases as we travel the path, with a few worth highlighting.

- In 2019, BMW rolling back $80/year for Apple CarPlay

- In 2022, BMW rolling back $18/month for heated seats

- In 2023, GM rolling back $1500/3-year OnStar subscriptions as a standard item

- To date, only two automotive manufacturers in the US continue to promote their own all-inclusive car subscription platform: Care by Volvo and Porsche Drive

The news on this front does not bode well for the future either. The Wall Street Journal recently proclaimed, “People Are Sick and Tired of All Their Subscriptions,” and reported that, from Q3 ‘22 to Q4 ‘23, subscription cancellations outpaced new subscriptions for digital memberships. Inflation has added to the pressure on subscription viability.

We see this directly impacting the viability of automotive in-vehicle subscriptions, especially as vehicle prices continue to increase. Loan rates are the highest they have been in 15 years, average payments on new cars are at an all-time high (the average is now $730/month, with 17% of new vehicle owners paying over $1000/month), and over 30% of vehicle loans are 6+ years in duration.

A strained market

But assuming 1) consumers aren’t yet burned out on the subscription marketplace, and 2) continue to have money to spend in the face of cost-of-living increases, would individuals pay for these services anyway? Very likely no, especially if the product doesn’t differentiate itself in a meaningful way. US consumers believe the following items should be included in the standard cost of a vehicle:

- 92% say heated and cooling seats

- 89% say remote start

- 89% say lane keeping assist

- 87% say automatic emergency braking

And the discrepancy between what companies estimate consumers will pay and what they’re willing to fork over is substantial. Cox estimates that of the 25% of new car buyers actually willing to pay anything, the max amount is between $61-90/month. A far cry from General Motors’ estimates of $135/month.

Where do the opportunities lie?

Mary Barra, CEO of General Motors, publicly stated she expects $20-25B in revenue by 2030 for subscription services for GM alone. But it took less than one year for GM to roll back their $1500, 3-year OnStar subscription plan in all GMC, Buick and Cadillac vehicles, and there’s no new revenue stream to take its place.

In the current landscape, when measured against increasing price pressure on the customer in the new vehicle market, the lack of visionary thinking as applied to the in-vehicle platforms/applications space, and the clear lack of interest by US consumers to pay for in-vehicle subscriptions, it seems fairly obvious a dynamic shift in how companies approach this area of the market is necessary.

When the major automakers current platforms are analyzed (specifically Toyota, Honda, Audi, and General Motors), the number of features that stand out is non-existent, as almost every single item is provided by the individual’s current mobility device(s) or the consumer expects them to be standard.

As the automotive manufacturers seek to bring Mobility as a Service (MaaS) to the marketplace, they must start seeking more viable solutions – and that starts with empathy for their customers. How can I make their life better and how can we differentiate from a saturated digital market currently owned by Apple, Google, and Samsung? The mobile devices of today will be much different than those of the near future – so simply eliminating every option current devices provide and every MaaS option the consumer believes should be standard is not a sustainable path. Auto-manufacturers that are thinking of feature parity with existing devices are thinking for the short-game, the long game is to build what tomorrow needs today. To create material change and to transform OEM revenue models manufactures must master digital product strategy and create a culture of constant evolution.

Building what tomorrow needs today

If the market is ready for automotive subscription services, you can bet that automakers will be happy to respond. But this doesn’t guarantee success. We’ll need to consider how user expectations have changed, how product offerings are evolving, and the looming question of cost. These are all factors that will affect the viability of subscriptions.

For businesses in the auto industry seeking to forge a new path and extend their competitive advantage, the shift toward adopting a product approach represents a major opportunity. By working with us and taking advantage of new technologies in automation, infrastructure design, and software development, you can realize transformative benefits that improve your business and accelerate outcomes.

ABOUT THE AUTHOR

Chris Ripley, Client Partner and Industrial Go-to-Lead, is who we call the “the car expert.” Specializing in the Auto, Aerospace & Defense, Electronic, Industrial Products, Oil & Gas, Chemicals, and Petroleum sectors, Ripley leads our Product teams and helps our clients identify key areas of opportunity to accelerate growth. He specializes in the process of leading new product launches and overseeing P&L responsibilities, coupled with being on top of latest industry trends, Ripley has been the most valuable in developing new client partnerships and accelerating revenue generation.

Connect with Chris on LinkedIn